Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 11, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 51:

The relevance of a particular cost to a decision is determined by?

A. Riskiness of the decision,

B. Number of decision variables

C. Amount of the cost.

D. Potential effect on the decision.

-

Question 52:

Systematic evaluation of the trade-offs between product functionality and product cost while still satisfying customer needs is the definition of

A. Activity-based management

B. Theory of constraints.

C. Total quality management.

D. Value engineering.

-

Question 53:

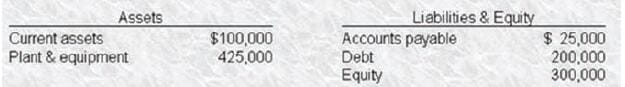

Finn Products, a start-up company, wants to use cost-based pricing for its only product, a unique new video game. Finn expects to sell 10.000 units in the upcoming year. Variable costs will be $65 per unit and annual fixed operating costs (including depreciation) amount to $80,000 Finn's balance sheet is as follows:

If Finn wants to earn a 20% return on equity, at what price should at sell the new product?

A. $75.00

B. $78.60

C. $79.00

D. $81.00

-

Question 54:

Pazer, Inc produces portable televisions. Pazer's product manager proposes to increase the cost structure by adding voice-activated volume/channel controls to the television, and also adding three additional repair personnel to deal with products returned due to defects, Are these costs value-added or nonvalue-added? Cost of Voice-Activated Controls Cost of Additional Repair Personnel

A. Value-added Value-added

B. Value-added Nonvalue-added

C. Norivalue-added Value-added D. Nonvalue-added Nonvalue-added

-

Question 55:

The Alpha Division of a company, which is operating at capacity, produces and sells 1.000 units of a certain electronic component in a perfectly competitive market. Revenue and cost data are as follows: Sales $50,000 Variable costs 34,000 Fixed costs 12,000 The minimum transfer price that should be charged to the Beta Division of the same company for each component is

A. $12

B. $34

C. $46

D. $50

-

Question 56:

Assume that the Plastics Division has excess capacity and it has negotiated a transfer price of $5.60 per plastic component with the Entertainment Division. This price will

A. Cause the Plastics Division to reduce the number of commercial plastic components it manufactures.

B. Motivate both divisions as estimated profits are shared.

C. Encourage the Entertainment Division to seek an outside source for plastic components

D. Demotivate the Plastics Division causing mediocre performance

-

Question 57:

Assume that the Entertainment Division is able to purchase a large quantity of video cards from an outside source at $8.70 per unit. The Video Cards Division, having excess capacity, agrees to lower its transfer price to $8.70 per unit. This action would

A. Optimize the profit goals of the Entertainment Division while subverting the profit goals of Parkside.

B. Allow evaluation of both divisions on the same basis.

C. Subvert the profit goals of the Video Cards Division while optimizing the profit goals of the Entertainment Division.

D. Optimize the overall profit goals of Parkside.

-

Question 58:

A per-unit transfer price from the Video Cards Division to the Entertainment Division at full cost. $9.15, would

A. Allow evaluation of both divisions on a competitive basis.

B. Satisfy the Video Cards Division's profit desire by allowing recovery of opportunity costs.

C. Provide no profit incentive for the Video Cards Division to control or reduce costs.

D. Encourage the Entertainment Division to purchase video cards from an outside source.

-

Question 59:

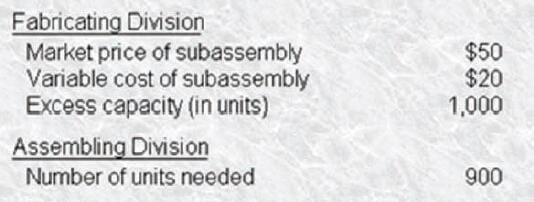

An appropriate transfer price between two divisions of The Stark Company can be determined from the following data:

What is the natural bargaining range for the two divisions?

A. Between $20 and $50.

B. Between $50 and $70.

C. Any amount less than $50.

D. $50 is the only acceptable price.

-

Question 60:

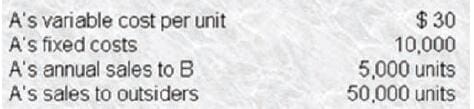

A company has two divisions, A and B, each operated as a profit center. A charges B $35 per unit for each unit transferred to B. Other data follow:

A is planning to raise its transfer price to $50 per unit Division B can purchase units at $40 each from outsiders, but doing so would idle A's facilities now committed to producing units for B. Division A cannot increase its sales to outsiders. From the perspective of the company as a whole, from whom should Division B acquire the units, assuming B's market is unaffected?

A. Outside vendors

B. Division A, but only at the variable cost per unit

C. Division A, but only until fixed costs are covered, then from outside vendors,

D. Division A, despite the increased transfer price.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.