Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 19, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 581:

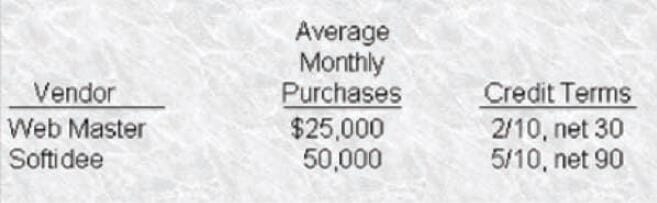

CyberAge Outlet, a relatively new store, is a cafe that offers customers the opportunity to browse the Internet or play computer games at their tables while they drink coffee. The customer pays a fee based on the amount of time spent signed on to the computer. The store also sells books, tee-shirts, and computer accessories. CyberAge has been paying all of its bills on the last day of the payment period, thus forfeiting all supplier discounts. Shown below are data on CyberAge's two major vendors, including average monthly purchases and credit terms.

The amount Morton Company must borrow to pay the supplier within the discount period and cover the

compensating balance is

A. $60,000%

B. $650,934

C. $64,615

D. $58.800

-

Question 582:

Commercial paper

A. Has a maturity date greater than 1 year.

B. Is usually sold only through investment banking dealers.

C. Ordinarily does not have an active secondary market

D. Has an interest rate lower than Treasury bills.

-

Question 583:

A company enters into an agreement with a firm that will factor the company's accounts receivable. The factor agrees to buy the company's receivables, which average $100,000 per month and have an average collection period of 30 days. The factor will advance up to 80% of the face value of receivables at an annual rate of 10% and charge a fee of 2% on all receivables purchased. The controller of the company estimates that the company would save $18,000 in collection expenses over the year. Fees and interest are not deducted in advance. Assuming a 360-day year, what is the annual cost of financing?

A. 10.0%

B. 12.0%

C. 14.0%

D. 17.5%

-

Question 584:

If a firm purchases raw materials from its supplier on a 2/10, net 40, cash discount basis, the equivalent annual interest rate (using a 360-day year) of forgoing the cash discount and making payment on the 40th day is

A. 2%

B. 18.36%

C. 24.49%

D. 36.72%

-

Question 585:

The Frame Supply Company has just acquired a large account and needs to increase its working capital by $100,000. The controller of the company has identified the four sources of funds given below.

1.

Pay a factor to buy the company's receivables, which average $125,000 per month and have an average collection period of 30 days. The factor will advance up to 80% of the face value of receivables at 10% and charge a fee of 2% on all receivables purchased. The controller estimates that the firm would save $24,000 in collection expenses over the year. Assume the fee and interest are not deductible in advance.

2.

Borrow $110,000 from a bank at 12% interest. A 9% compensating balance would be required.

3.

Issue $110,000 of 6-month commercial paper to net $100,000 (New paper would be issued every 6 months.)

4.

Borrow $125,000 from a bank on a discount basis at 20%. No compensating balance would be required. Assume a 360-day year in all of your calculations. The cost of Alternative 4. to Frame Supply Company is

A. 20.0%

B. 25.0%

C. 40.0%

D. 50.0%

-

Question 586:

The Frame Supply Company has just acquired a large account and needs to increase its working capital by $100,000. The controller of the company has identified the four sources of funds given below.

1.

Pay a factor to buy the company's receivables, which average $125,000 per month and have an average collection period of 30 days. The factor will advance up to 80% of the face value of receivables at 10% and charge a fee of 2% on all receivables purchased. The controller estimates that the firm would save $24,000 in collection expenses over the year. Assume the fee and interest are not deductible in advance.

2.

Borrow $110,000 from a bank at 12% interest. A 9% compensating balance would be required.

3.

Issue $110,000 of 6-month commercial paper to net $100,000 (New paper would be issued every 6 months.)

4.

Borrow $125000 from a bank on a discount basis at 20%. No compensating balance would be required. Assume a 360-day year in all of your calculations. The cost of Alternative 3. to Frame Supply Company is

A. 9.1%

B. 10.0%

C. 18.2%

D. 20.0%

-

Question 587:

The frame Supply Company has just acquired a large account and needs to increase its working capital by $100,000. The controller of the company has identified the four sources of funds given below.

1.

Pay a factor to buy the company's receivable, which average $125,000 per month and have an average collection period of 30 days. The factor will advance u to 80% of the face value of receivables at 10% and charge a fee of 2%.

2.

Borrow $110,000 from a bank at 12% interest. A 9% compensating balance would be required.

3.

Issue $110,000 of 6-month commercial paper to net $100,000 (New paper would be issued every 6 months.)

4.

Borrow $125,000 from a bank on a discount basis at 20%. No compensating balance would be required. Assume a 360-day year in all of your calculations. The cost of Alternative 2. to Frame Supply Company is

A. 9.0%

B. 12.0%

C. 13.2%

D. 21.0%

-

Question 588:

The Frame Supply Company has just acquired a large account and needs to increase its working capital by $100,000. The controller of the company has identified the four sources of funds given below.

1.

Pay a factor to buy the company's receivables, which average $125,000 per month and have an average collection period of 30 days. The factor will advance up to 80% of the face value of receivables at 10% and charge a fee of 2% on all receivables purchased. The controller estimates that the firm would save $24,000 in collection expenses over the year Assume the fee and interest are not deductible in advance

2.

Borrow $110000 from a bank at 12% interest A 9% compensating balance would be required.

3.

Issue $110,000 of 6-month commercial paper to net $100,000 (New paper would be issued every 6 months.)

4.

Borrow $125,000 from a bank on a discount basis at 20%. No compensating balance would be required. Assume a 360-day year in all of your calculations. The cost of Alternative 1. to Frame Supply Company is

A. 10.0%

B. 12.0%

C. 132%

D. 16.0%

-

Question 589:

Which of the following responses is not an advantage to a corporation that uses the commercial paper market for short-term financing?

A. This market provides more funds at lower rates than other methods provide

B. The borrower avoids the expense of maintaining a compensating balance with a commercial bank.

C. There are no restrictions as to the type of corporation that can enter into this market.

D. This market provides a broad distribution for borrowing.

-

Question 590:

Assuming a 360-day year, the current price of a $100 U.S. Treasury bill due in 180 days on a 6% discount basis is

A. $97.00

B. $94.00

C. $100.00

D. $93.00

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.