Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 19, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 551:

Using a 380-day year, what is the opportunity cost to a buyer of not accepting terms 3/10, net 45?

A. 55.67%

B. 31.81%

C. 22.27%

D. 101.73%

-

Question 552:

Richardson Supply has a $100 invoice with payment terms of 2/10, net 60. Richardson can either take the discount or place the funds in a money market account pang 6% interest. Using a 360-day year, Richardson's cost of not talking the cash discount is

A. 12.2%.

B. 8.7%

C. 6.4%

D. 6.2%.

-

Question 553:

A small retail business would most likely finance its merchandise inventory with

A. Commercial paper

B. A terminal warehouse receipt loan.

C. A line of credit.

D. A chattel mortgage.

-

Question 554:

Short-term, unsecured promissory notes issued by large firms are known as

A. Agency securities.

B. Bankers' acceptances.

C. Commercial paper.

D. Repurchase agreements.

-

Question 555:

The prime rate is the

A. Size of the commitment fee on a commercial bank loan.

B. Effective coat of a commercial bank loan.

C. Effective cost of commercial paper

D. Pate charged on business loans to borrowers with high credit ratings.

-

Question 556:

The prime lending rate of commercial banks is an announced rate and is often understated from the viewpoint of even the most credit-worthy firms. Which one of the following requirements always results in a higher effective interest rate?

A. A floating rate for the loan period

B. A covenant that restricts the issuance of any new unsecured bonds during the existence of the loan.

C. The imposition of a compensating balance with an absolute minimum that cannot be met by current transaction balances.

D. The absence of a charge for any unused portion in the line of credit.

-

Question 557:

Which one of the following statements about trade credit is correct? Trade credit is

A. Not an important source of financing for small firms.

B. A source of long-term financing to the seller.

C. Subject to risk of buyer default.

D. Usually an inexpensive source of external financing.

-

Question 558:

A company has daily cash receipts of $150,000. The treasurer of the company has investigated a lockbox service whereby the bank that offers this service will reduce the company's collection time by four days at a monthly fee of $2,500. money market rates average 4% during the year, the additional annual income (loss) from using the lockbox service would be

A. $6,000

B. $(6,000)

C. $12,000

D. $(12,000)

-

Question 559:

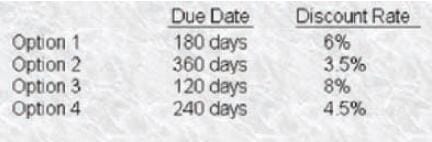

Hendnx, Inc. is interested in purchasing a $100 U.S. Treasury bill and was presented with the following options:

If Hendrix wishes to buy the Treasury bill at the lowest purchasing price, which option should be chosen, assuming a 360- day year?

A. Option 1.

B. Option 2.

C. Option 3.

D. Option 4.

-

Question 560:

A manufacturing firm wants to obtain a short-term loan and has approached several lending institutions. All of the potential lenders are offering the same nominal interest rate but the terms of the loans vary. Which of the following combinations of loan terms will be most attractive for the borrowing firm?

A. Simple interest, no compensating balance.

B. Discount interest, no compensating balance.

C. Simple interest, 20% compensating balance required.

D. Discount interest, 20% compensating balance required.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.