Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 11, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 31:

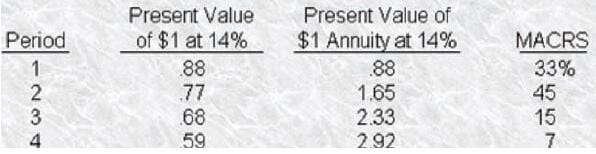

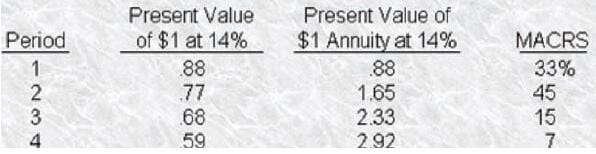

On January 1, Crane Company will acquire a new asset that costs $400,000 and is anticipated to have a salvage value of $30,000 at the end 014 years. The new asset - Qualifies as 3-year property under the Modified Accelerated Cost Recovery System (MACRS). Will replace an old asset that currently has a tax basis of $80,000 and can be sold now for $60,000. Will continue to generate the same operating revenues as the old asset ($200,000 per year). However, savings in operating costs will be experienced as follows: a total of $1 20.000 in each of the first 3 years and $90,000 in the fourth year. Crane is subject to a 40% tax rate and rounds all computations to the nearest dollar. Assume that any gain or loss affects the taxes paid at the end of the year in which it occurred. The company uses the net present value method to analyze projects using the following factors and rates:

The discounted net-of-tax amount that should be factored into Crane Company's analysis for the disposal transaction is?

A. $45,760.

B. $60,000.

C. $67,040.

D. $68,000.

-

Question 32:

On January 1. Crane Company will acquire a new asset that costs $400,000 and is anticipated to have a salvage value of $30,000 at the end of 4 years. The new asset - Qualifies as 3-year property under the Modified Accelerated Cost Recovery System (MACRS). Will replace an old asset that currently has a tax basis of $80,000 and can be sold now for $60,000. Will continue to generate the same operating revenues as the old asset ($200 .000 per year). However, savings in operating costs will be experienced as follows: a total of $ 120.000 in each of the first 3 years and $90,000 in the fourth year. Crane is subject to a 40% tax rate and rounds all computations to the nearest dollar. Assume that any gain or loss affects the taxes paid at the end of the year in which it occurred. The company uses the net present value method to analyze projects using the following factors and rates:

The present value of the depreciation tax shield for the fourth year MACRS depreciation of Crane Company's new asset is?

A. $0.

B. $6,112.

C. $6,608.

D. $16,520.

-

Question 33:

The Dickins Corporation is considering the acquisition of a new machine at a cost of $180,000. Transporting the machine to Dickins' plant will cost $12,000. Installing the machine will cost an additional $18.000. It has a 10-year life and is expected to have a salvage value of $10,000. Furthermore, the machine Es expected to produce 4.000 units per year with a selling price of $500 and combined direct materials and direct labor costs of $450 per unit. Federal tax regulations permit machines of this type to be depreciated using the straight-line method over 5 years with no estimated salvage value Dickins has a marginal tax rate of 40%. What is the net cash flow for the tenth year of the project that Dickins should use in a capital budgeting analysis?

A. $200,000

B. $158,000

C. $136,800

D. $126,000

-

Question 34:

The Dickins Corporation is considering the acquisition of a new machine at a cost of $ 180.000. Transporting the machine to Dickins' plant will cost $12,000. Installing the machine will cost an additional $18,000. It has a 10-year life and is expected to have a salvage value of $10,000. Furthermore, the machine is expected to produce 4,000 units per year with a selling price of $500 and combined direct materials and direct labor costs of $450 per unit. Federal tax regulations permit machines of this type to be depreciated using the straight-line method over 5 years with no estimated salvage value, Dickins has a marginal tax rate of 40%. What is the net cash flow for the third year that Dickins should use in a capital budgeting analysis?

A. $136,800

B. $136,000

C. $128,400

D. $107,400

-

Question 35:

The Dickens Corporation is considering the acquisition of a new machine at a cost of $180,000. Transporting the machine to Dickins' plant will cost $1 2.000. Installing the machine will cost an additional $18,000. It has a 10-year life and is expected to have a salvage value of $10,000. Furthermore, the machine is expected to produce 4.000 units per year with a selling price of $500 and combined direct materials and direct labor costs of $450 per unit. Federal tax regulations permit machines of this ripe to be depreciated using the straight-line method over 5 years with no estimated salvage value. Dickens has a marginal tax rate of 40%. What is the net cash outflow at the beginning of the first year that Dickens should use in a capital budgeting analysis?

A. $(170,000)

B. $(180.000)

C. $(192,000)

D. $(210,000)

-

Question 36:

Kore Industries is analyzing a capital investment proposal for new equipment to produce a product over the next 8 years. The analyst is attempting to determine the appropriate "end-of-life cash flows for the analysis. At the end of 8 years, the equipment must be removed from the plant and will have a net book value of zero, a tax basis of $75,000, a cost to remove of $40,000. and scrap salvage value of $10,000. Kore's effective tax rate is 40%. Valiant is the appropriate endow-life cash flow related to these items that should be used in the analysis?

A. $45,000

B. $27,000

C. $12,000

D. $(18,000)

-

Question 37:

Metrejean Industries is analyzing a capital investment proposal for new equipment to produce a product over the next 8 years. At the end of 8 years, the equipment must be removed from the plant and will have a net caring amount of $0. a tax basis of $150,000. a cost to remove of $80,000. and scrap salvage value of $20,000. Metrejean's effective tax rate is 40%. What is the appropriate enc$-of-life" cash flow related to these items that should be used in the analysis?

A. $90,000

B. $54,000

C. $24,000

D. $(36,000)

-

Question 38:

The Moore Corporation is considering the acquisition of a new machine. The machine can be purchased for $90,000; twill cost $6,000 to transport to Moore's plant and $9,000 to install. It is estimated that the machine will last 10 years, and it is expected to have an estimated salvage value of $5,000. Over its 10year life, the machine is expected to produce 2,000 units per year with a selling price of $500 and combined material and labor costs of $450 per unit. Federal tax regulations permit machines of this type to be depreciated using the straight-line method over 5 years with no estimated salvage value. Moore ha a marginal tax rate of 40%. What is the net cash flow for the tenth year of the project that Moore Corporation should use in a capital budgeting analysis?

A. $100,000

B. $81,000

C. $68,400

D. $63,000

-

Question 39:

The Moore Corporation is considering the acquisition of a new machine. The machine can be purchased for $90,000; twill cost $6,000 to transport to Moore's plant and $9,000 to install. It is seated that the machine will last 10 years. and it Es expected to have an estimated salvage value of $5,000. Over its 10year life, the machine is expected to produce 2,000 units per year with a selling price of $500 and combined material and labor costs of $450 per unit. Federal tax regulations permit machines of this type to be depreciated using the straight-line method over 5 years with no estimated salvage value. Moore ha a marginal tax rate of 40%. What is the net cash flow for the third year that Moore Corporation should use in a capital budgeting analysis?

A. $68,400

B. $68,000

C. $64,200

D. $79,000

-

Question 40:

The Moore Corporation is considering the acquisition of a new machine. The machine can be purchased for $90,000; it will cost $6,000 to transport to Moore's plant and $9,000 to install. It is estimated that the machine will last 10 years, and it is expected to have an estimated salvage value of $5,0O0 Over its 10year life, the machine is expected to produce 2,000 units per year with a selling price of $500 and combined material and labor costs of $450 per unit. Federal tax regulations permit machines of this type to be depreciated using the straight-line method over 5 years with no estimated salvage value. Moore has a marginal tax rate of 40%. What is the net cash outflow at the beginning of the first year that Moore Corporation should use in a capital budgeting analysis?

A. $(85,000)

B. $(90,000)

C. $(96,000)

D. $(105,000)

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.