Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 19, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 381:

Cat fur Company has fixed costs of $300,000. It produces two products, X and Y. Product X has a variable cost percentage equal to 60% of its $10 per unit selling price Product Y has a variable cost percentage equal to 70% of its $30 selling price For the past several years, sales of Product X have averaged 66% of the sales of Product Y. That ratio is not expected to change. Assume that Cat fur Company achieved its planned breakeven level of sales in dollars, but the mix of products sold was one-to- one. All actual costs and unit selling prices equaled budgeted amounts. What is the impact on profitability?

A. The company is operating at the breakeven point.

B. The company earned a profit.

C. The company sustained a loss.

D. Cannot be deterrence from the informant given.

-

Question 382:

Cat fur Company has fixed costs of $300.000. It produces two products, X and Y Product X has a variable cost percentage equal to 60% of its $10 per unit selling price. Product Y has a variable cost percentage equal to 70% of its $30 selling price. For the past several years, sales of Product X have averaged 66% of the sales of Product Y. That ratio is not expected to change. How many units of Product Y will Cat fur sell at the breakeven point?

A. 8,571 units.

B. 20.454 units.

C. 23.377 units.

D. 25,714 units.

-

Question 383:

Cat fur Company has fixed costs of $300,000. It produces two products, X and Y Product has a van able cost percentage equal to 60% of its $10 per unit selling price Product Y has a variable cost percentage equal to 70% of its $30 selling price. For the past several years, sales of Product X have averaged 66% of the sales of Product Y. That ratio is not expected to change. What is Cat furs breakeven point in dollars?

A. $300,000

B. $750,000

C. $857,142

D. $942,857

-

Question 384:

A company wants to open a new store in one of two nearby shopping malls. In Mall A. the rent will be $250 .000 per year. In Mall B. the rent will be 4% of gross revenues. Assuming that revenues and all other elements under consideration are the same for both malls, at what level of revenues will the company be indifferent between the two malls?

A. $1 .000.000

B. $4.000.000

C. $6.250.000

D. $12,500,000

-

Question 385:

For one of its divisions, Buona Fortuna Company has fixed costs of $300,000 and a variable-cost percentage equal to 60% of its $10 per unit selling price. It would like to earn a pre-tax income of $90,000 per year from the division. How many units will Buona Fortuna have to sell to earn a pre-tax income of $90,000 per year?

A. 65.000 units.

B. 75.000 units.

C. 77.250 units,

D. 97,500 units.

-

Question 386:

For one of its divisions, Buona Fortune Company has fixed costs of $300,000 and a van able-cost percentage equal to 60% of its $10 per unit selling price. It would like to earn a pre-tax income 01 $90,000 per year from the division. What is the breakeven point in dollars?

A. $300,000

B. $500,000

C. $750,000

D. $1,050,000

-

Question 387:

A company has sales of one of its products of $400,000 per year and a contribution margin ratio of 20%. Its margin of safety is $40,000. What are the company's fixed costs?

A. $72,000

B. $80,000

C. $288,000

D. $320,000

-

Question 388:

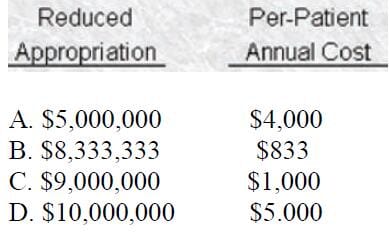

A not-for-profit social agency provides home health care assistance to as many patients as possible s budgeted appropriation CX) for next year must cover fixed costs of $5 million. and the annual per-patient cost (Y) of its services. However, the agency is preparing for a possible 10% reduction in its appropriation that will lower the number of patients served from 5,000 to 4,000 The reduced appropriation and the annual per- patient cost equal

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 389:

A company has sales of one of its products of $400,000 per year and a contribution margin ratio of 20%. s margin of safety is $40,000 What is the company's breakeven point?

A. $360,000

B. $320,000

C. $288,000

D. $80,000

-

Question 390:

A manufacturing concern sells its sole product for $10 per unit, with a unit contribution margin of $6. The fixed manufacturing cost rate per unit is $2 based on a denominator capacity of 1 million units, and fixed marketing costs are $1.5 million. If 900,000 units are produced, the absorption-costing breakeven point in units sold is

A. 425,000 units

B. 583.333 units

C. 900,000 units

D. 1,000,000 units

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.