Exam Details

Exam Code

:ICBRRExam Name

:International Certificate in Banking Risk and Regulation (ICBRR)Certification

:GARP CertificationsVendor

:GARPTotal Questions

:342 Q&AsLast Updated

:Jun 14, 2025

GARP GARP Certifications ICBRR Questions & Answers

-

Question 201:

Which type of risk does a bank incur on loans that are in the "pipeline", i.e loans that are in the process of origination but not yet originated?

A. Interest rate risk and credit risk

B. Interest rate risk only

C. Credit Risk only

D. The bank does not incur any risk since the loan is not yet originated

-

Question 202:

An endowment asset manager with a focus on long/short equity strategies is evaluating the risks of an equity portfolio. Which of the following risk types does the asset manager need to consider when evaluating her diversified equity portfolio?

A. Company-specific projected earnings and earnings risk II. Aggregate earnings expectations

III. Market liquidity

IV. Individual asset volatility

B. I

C. I, IV

D. II, III

E. I, II, IV

-

Question 203:

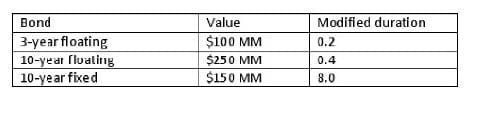

A portfolio consists of two floating rate bonds and one fixed rate bond.

Based on the information below, modified duration of this portfolio is

A. 2.64

B. 3.00

C. 4.28

D. 4.44

-

Question 204:

A large multinational bank is concerned that their duration measures may not be accurate since the yield curve shifts are not parallel. Which of the following statements would be typically observed regarding variability of interest rates?

A. Short-term rates are more variable than long-term rates.

B. Short-term rates are less variable than long-term rates.

C. Short-term rates are equally variable as long-term rates.

D. Short-term rates and long-term rates always move in opposite directions.

-

Question 205:

Which one of the four following statements about back testing the VaR models is correct? Back testing requires

A. Plotting VaR forecasts against the proportion of daily losses exceeding the average loss.

B. Comparing the predictive ability of VaR on a daily basis to the realized daily profits and losses.

C. Plotting the daily profit and losses along with the ranges predicted by VaR models

D. Determining the proportion of daily profits exceeding those predicted by VaR.

-

Question 206:

James Johnson bought a coupon bond yielding 4.7% for $1,000. Assuming that the price drops to $976 when yield increases to 4.71%, what is the PVBP of the bond.

A. $26.

B. $76.

C. $870.

D. $976.

-

Question 207:

Modified duration of a bond measures:

A. The change in value of a bond when yields increase by 1 basis point.

B. The percentage change in a bond price when yields increase by 1 basis point.

C. The present value of the future cash flows of a bond calculated at a yield equal to 1%.

D. The percentage change in a bond price when the yields change by 1%.

-

Question 208:

Present value of a basis point (PVBP) is one of the ways to quantify the risk of a bond, and it measures:

A. The change in value of a bond when yields increase by 0.01%.

B. The percentage change in bond price when yields change by 1 basis point.

C. The present value of the future cash flows of a bond calculated at a yield equal to 1%.

D. The percentage change in bond price when the yields change by 1%.

-

Question 209:

In analyzing the historical performance of a financial product, you are concerned about "fat tails", the probability of extreme returns compared to realized returns. Which of the following measures should you use to determine if the product return distribution of the product has "fat tails"?

A. Mean

B. Standard deviation

C. Skewness

D. Kurtosis

-

Question 210:

Oliver McCarthy owns a portfolio of bonds. Which of the following choices equals the modified duration of Oliver's portfolio?

A. Minimum of the modified durations of the component bonds

B. Value-weighted average modified duration of the component bonds

C. Coupon-weighted average modified duration of the component bonds

D. Maximum of the modified durations of component bonds

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only GARP exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your ICBRR exam preparations and GARP certification application, do not hesitate to visit our Vcedump.com to find your solutions here.