Exam Details

Exam Code

:ICBRRExam Name

:International Certificate in Banking Risk and Regulation (ICBRR)Certification

:GARP CertificationsVendor

:GARPTotal Questions

:342 Q&AsLast Updated

:Jun 14, 2025

GARP GARP Certifications ICBRR Questions & Answers

-

Question 151:

Which one of the following four exercise features is typical for the most exchange-traded equity options?

A. Asian exercise feature

B. American exercise feature

C. European exercise feature

D. A shout option exercise feature

-

Question 152:

James Arthur is a customer of a bank who has taken a floating rate loan from the bank. He is concerned that the rates may rise in the future increasing his payment amount. Which of the following instruments should he buy to hedge against the rise in interest rates?

A. Interest rate floor

B. Interest rate cap

C. Index amortizing swap

D. Interest rate swap that receives fixed and pays floating

-

Question 153:

James Johnson bought a 3-year plain vanilla bond that has yield of 4.7% and 4% coupon paid annually, for $87,139. Macauley's duration of the bond is 2.94 years. Rate volatility is 20% of the yield. The bond's annualized volatility is therefore:

A. 3.15%.

B. 2.90%.

C. 2.81%.

D. 2.64%.

-

Question 154:

Since most consumers of natural gas do not have the ability to store it, they contract with gas suppliers to receive a flow of natural gas equal to a specific number of MMBT's per day (MMBT is millions of British Termal Units, the unit in which gas futures are quoted on the

A. S. markets). To protect against price increases with a bank, the natural gas consumer, concerned with the average price over the course of the month, will use the following contracts:

B. American options

C. Asian options

D. Compound options

E. Flexible volume options

-

Question 155:

On January 1, 2010 the TED (treasury-euro dollar) spread was 0.9%, and on January 31, 2010 the TED spread is 0.4%. As a risk manager, how would you interpret this change?

A. The decrease in the TED spread indicates a decrease in credit risk on interbank loans.

B. The decrease in the TED spread indicates an increase in credit risk on interbank loans.

C. Increase in interest rates on both interbank loans and T-bills.

D. Increase in credit risk on T-bills.

-

Question 156:

Which of the following statements regarding collateralized debt obligations (CDOs) is correct?

A. CDOs typically have loans or bonds as underlying collateral.

II. CDOs generally less risky than CMOs.

III. There is a correlation among defaults in the CDO collateral which should be considered in valuation of these complex instruments.

B. I only

C. I and III

D. II and III

E. I, II, and III

-

Question 157:

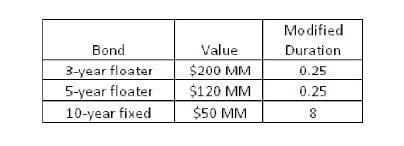

A bank owns a portfolio of bonds whose composition is shown below.

What is the modified duration of the portfolio?

A. 1.30

B. 8.5

C. 2.30

D. 0.5

-

Question 158:

In additional to the commodity-specific risks, which of the following risks represent the main commodity derivative risks?

A. Basis

II. Term

III. Correlation

IV. Seasonality

B. I, II

C. II, III

D. I, IV

E. I, II, III, IV

-

Question 159:

Which of the following statements about the option gamma is correct? Gamma is the

A. Second derivative of the option value with respect to the volatility.

II. Percentage change in option value per percentage change in the price of the underlying instrument.

III. Second derivative of the value function with respect to the price of the underlying instrument.

IV. Rate of change of the option delta with respect to changes in the underlying price.

B. I only

C. II and III

D. III and IV

E. II, III, and IV

-

Question 160:

A risk associate is trying to determine the required risk-adjusted rate of return on a stock using the Capital Asset Pricing Model. Which of the following equations should she use to calculate the required return?

A. Required return = risk-free return + beta x market risk

B. Required return = (1-risk free return) + beta x market risk

C. Required return = risk-free return + beta x (1 ?market risk)

D. Required return = risk-free return + 1/beta x market risk

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only GARP exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your ICBRR exam preparations and GARP certification application, do not hesitate to visit our Vcedump.com to find your solutions here.