Exam Details

Exam Code

:CRCMExam Name

:Certified Regulatory Compliance Manager CRCMCertification

:American Bankers Association CertificationsVendor

:American Bankers AssociationTotal Questions

:463 Q&AsLast Updated

:

American Bankers Association American Bankers Association Certifications CRCM Questions & Answers

-

Question 1:

To be effective, compliance risk management professionals must design a framework to ensure that bank management understands the risks and the steps that must be taken to mitigate them. The many roles compliance professionals fill incorporate risk management aspects including:

A. Coordinating regulatory exams to explain risks to examiners

B. Overseeing compliance training targeting higher risk areas

C. Tracking regulatory proposals and final rules to understand new risks

D. All of these

-

Question 2:

They also embrace the concept of risk-based compliance management. They expect compliance management to be tailored to the bank, be it large or small, offering standard or specialty financial services, simple or complex products lines, and adjusted as appropriate for the customer base as that issued for the Bank Secrecy Act, also establishes their expectations that a bank's program be risk based. Who are they?

A. Outsourcing firms

B. Foreign financial service providers

C. Bank regulatory agencies

D. Risk management organizations

-

Question 3:

A compliance professional's responsibilities include all of the following EXCEPT:

A. Understanding the business units operating environment and risk tolerance

B. Performing risk assessments with the assistance of business units to determine current risk levels and risks associated with the bank's products, lines of business, customers, and locations, among other factors

C. Working with business units to ensure prompt corrective action for any detected errors

D. Assisting business lines with compliance training for employees, as needed

-

Question 4:

should include basic elements designed to understand and mitigate risk.

It usually includes: Written program Compliance-related policies and procedures

A. Tactical Compliance procedure

B. Rank solution

C. Compliance program

D. None of these

-

Question 5:

In a compliance program, tactical compliance procedures should be integrated into business line procedures, such as how to deliver an Adverse Action Notice when an application is declined. In this case:

A. Regulations should be applied consistently to procedures throughout the bank

B. Revisions to procedures should be based on compliance expertise and not mere editing

C. Providing solutions to mitigate any identified risk

D. Assisting business units in developing or revising policies and procedures to reflect current regulatory requirements

-

Question 6:

Which of the following should be done during research and interpreting regulations Compliance professionals in mitigating compliance risk?

A. Track regulatory proposals

B. Implementing final regulatory rules

C. Understanding the business units' operating environment and risk tolerance

D. Ranking solutions as high, moderate and low risk

-

Question 7:

The compliance program should address plans to verify adherence to applicable regulations through:

A. Ongoing monitoring to evaluate the program, self monitoring and corrective action

B. Self monitoring

C. Periodic reviews

D. Ongoing monitoring to evaluate the program, self monitoring and periodic reviews

-

Question 8:

There is no established template for documenting compliance risk. Each institution should develop a risk assessment that fits its risk profile. The components that are commonly used throughout the industry are as follows EXCEPT:

A. Risk assessment

B. Measuring key risk indicators

C. Identifying key performance indicators

D. Training the leadership of compliance regulation program

-

Question 9:

In Compliance regulation and risk assessment key performance indicators usually include:

A. Fines or penalties

B. Customer complaints

C. Regulatory criticism from a regulator or internal or external auditors

D. None of these

-

Question 10:

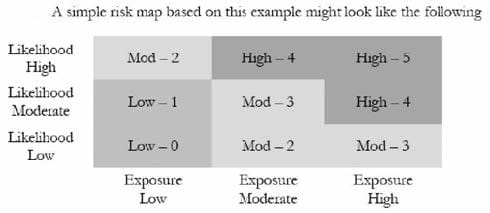

For example on a 0-5 scale: The risk trend shows the direction of risk and probable change to risk over the next 12 months. A trend toward increasing risk means that

A. Management may want to take additional action through more controls or increased reviews

B. Risk may prompt a decrease in controls and improved efficiencies

C. Controls currently in place are appropriate to succeed in keeping risks within management's established risk-tolerance level

D. Risk measurements exceed management's tolerance for risk

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only American Bankers Association exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CRCM exam preparations and American Bankers Association certification application, do not hesitate to visit our Vcedump.com to find your solutions here.