Exam Details

Exam Code

:CMAExam Name

:Certified Management AccountantCertification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 18, 2025

IMANET IMANET Certifications CMA Questions & Answers

-

Question 1:

A company is considering the purchase of a new machine to replace a five-year old machine and has gathered the following information: Purchase price of new machine $50,000 Installation cost of new machine 4,000 Market value (selling price) of the old machine 5,000 Book value of the old machine 2,000 Increase in net working capital if new machine is installed 1,000 Effective income tax rate 40% It the company replaces the old machine with the new machine, what is the cash flow in period 0?

A. $(49,000)

B. $(51.200)

C. $(51.800)

D. $(53.000)

-

Question 2:

Mobile Home Manufacturing, Inc. is evaluating a proposed acquisition of a new machine at a purchase price of $380,000 and installation charges that will amount to $20,000. A $15,000 increase in working capital will be required The machine will hate a useful life of four years, after which it can be sold for $50,000. The estimated annual incremental operating revenues and cash operating expenses are $750,000 and $500,000. respective, for each of the four years. Mobile Home's tax rate is 40%, and the cost of capital is 12%. Mobile Home uses straight-line depreciation for both financial reporting and income tax purposes. If Mobile Home accepts the project, the initial investment will be

A. $350,000

B. $365,000

C. $385,000

D. $415,000

-

Question 3:

The management of Pelican, Inc. is evaluating a proposed acquisition of a new machine at a purchase price of $180,000 and with installation costs of $10,000. A $9,000 increase in working capital will be required. The machine Will have a useful life of four years, after which it can be sold for $30,000. The estimated annual incremental operating revenues and cash operating expenses are $450,000 and $300.000, respectively, for each of the four years. Pelican's effective income tax rate is 40%. and the cost of capital is 12%. Pelican uses straight-line depreciation for both financial reporting and income tax purposes. If the project is accepted, the estimated incremental after-tax operating cash flows at the end of the first year wilt be?

A. $99,000

B. $106,000

C. $108,000

D. $150,000

-

Question 4:

The chief financial officer of Pauley, Inc has requested an evaluation of a proposed acquisition of a new machine at a purchase price of $60.000 and with installation costs of $10,000. A $3,000 increase in working capital will be required. The machine will have a useful life of four years. after which it can be sold for $10,000. The estimated annual incremental operating revenues and cash operating expenses are $150,000 and $100,000, respectively, for each of the four years. Pauley's effective income tax rate is 40%, and the cost of capital is 12%. Pauley uses straight-line depreciation for both financial reporting and income tax purposes. Pauley's estimated after-tax cash flow in the fourth year, at which time the equipment will be sold, will be?

A. $34,000

B. $45,000

C. $46,000

D. $49,000

-

Question 5:

The Hopkins Company has estimated that a proposed project's 10-year annual net cash benefit, received each year end. will be $2,500 with an additional terminal benefit of $5,000 at the end of the 10th year. Assuming that these cash inflows satisfy exactly Hopkins' required rate of return of 8%, calculate the initial cash outlay

A. $16,775

B. $19,090

C. $25,000

D. $30,000

-

Question 6:

Union Electric Company must clean up the water released from its generating plant. The company's cost of capital is 12 percent for average risk projects, and that rate is normally adjusted up or down by 2 percentage points for high- and low- risk projects. Clean-Up Plan A. which is of average risk, has an initial cost of $10 million, and its operating cost will be $1 million per year for its 10-year life. Plan B, which is a high-risk project, has an initial cost of $5 million, and its annual operating cost over Years 1 to 10 will be $2 million. What is the approximate PV of costs for the better project?

A. $15,432,000

B. $15,650,000

C. $16,300,000

D. $17,290,000

-

Question 7:

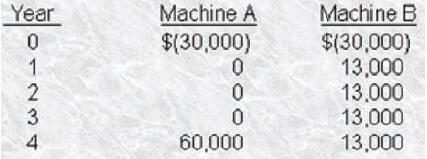

The U.S. Postal Service is looking for a new machine to help sort the mail. Two companies have submitted bids to Cliff Kraven, the postal inspector responsible for choosing a machine. A cash flow analysis of the two machines indicates the following: It the cost of capital for the Postal Service is 8%. which of the two mail sorters should Cliff choose and why?

A. Machine A. because NPV of A > NPV of B. by $1,044.

B. Machine B. because NPV of A > NPV of B. by $22,000.

C. Machine A. because NPV of A > NPV of B. by $8,000

D. Machine B. because IRR of A > IRR of B.

-

Question 8:

The tax impact of equipment depreciation affects capital budgeting decisions. Currently, me Modified Accelerated Cost Recover' System (MACRS) is used as the depreciation method for most assets for tax purposes. When employing the MACRS method of depreciation in a capita) budgeting decision, the use of MACRS as compared with the straight-line method of depreciation will result in?

A. Equal total depreciation for both methods.

B. MACRS producing less total depreciation than straight line.

C. Equal total tax payments, after discounting for the time value of money.

D. MACRS producing more total depreciation than straight line

-

Question 9:

The tax impact of equipment depreciation affects capital budgeting decisions. Currently, the Modified Accelerated Cost Recovery System (MACRS) is used as the depreciation method for most assets for tax purposes. The MACRS method of depreciation for assets with 3, 5. 7. and 1 0-year recovery periods is most similar to which one of the following depreciation methods used for financial reporting purposes?

A. Straight-line.

B. Units-of-production.

C. Sum-of-the-years'-digits.

D. 200% declining-balance.

-

Question 10:

Capital budgeting is used for the decision analysis of?

A. Adding product lines or facilities.

B. Multiple profitable alternatives.

C. Lease-or-buy decisions.

D. All of the answers are correct.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.