Exam Details

Exam Code

:CIMAPRO19-P02-1Exam Name

:P2 - Advanced Management AccountingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:202 Q&AsLast Updated

:Jun 29, 2025

CIMA CIMA Certifications CIMAPRO19-P02-1 Questions & Answers

-

Question 61:

An airline prides itself on using highly reliable aircraft that are maintained to the highest possible standard and that its flight crews are arguably the best in the industry. Despite that, the directors accept that there remains a slight possibility that

there will be a fatal accident.

Which THREE of the following statements are correct?

A. The airline appears to be behaving responsibly.

B. It is unlikely that any airline could totally eliminate all possibility of a fatal accident.

C. The airline's directors can justify their behavior on the basis that they insist on exceeding all relevant statutory and industry safety standards.

D. Fatal air accidents can be justified on the basis that some risk is inevitable.

E. The airline should cease operations in order to eliminate the risk of a fatal accident.

-

Question 62:

SDF makes cars. Demand for one of SDF's most popular models has declined because of a long- running television program. SDF's car is driven by a villainous character in the program and that has created such a negative association that

sales have declined so significantly that SDF is planning to discontinue production.

Which of the following statements is correct? Select ALL that apply.

A. Business risks can arise from unexpected events.

B. The use of a product in a television program can create upside risks.

C. SDF should have considered the possibility that sales of this car could be affected by public perception, even though the car's practical attributes are unchanged.

D. SDF's board should accept full responsibility for permitting this to happen.

E. SDF's sales department should have prevented the television production company from buying the car.

-

Question 63:

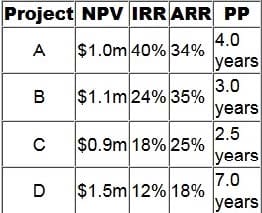

Four mutually exclusive projects have been appraised as follows using net present value (NPV), internal rate of return (IRR), accounting rate of return (ARR) and payback period (PP).

Recommend which of the projects should be chosen.

A. Project A B. Project B

C. Project C

D. Project D

-

Question 64:

Which of the following statements is correct?

A. Risk can be quantified and probabilities can be assigned reliably to the possible outcomes.

B. Uncertainty cannot be quantified and probabilities can be assigned reliably to the possible outcomes.

C. Risk cannot be quantified and probabilities cannot be assigned reliably to the possible outcomes.

D. Uncertainty can be quantified and probabilities can be assigned reliably to the possible outcomes.

-

Question 65:

A small company currently uses an information system that was implemented several years ago and is based entirely on internal data. The company is considering replacing it with a more up to date system. It has been suggested that the

new system should include the use of big data.

Which TWO of the following statements are correct?

A. Big data can provide a small company with useful information in the quest for competitive advantage.

B. Big data is concerned solely with a dramatic increase in the amount of internal data stored.

C. Big data can be used by a small company to identify new opportunities.

D. It is not possible to value the potential benefits to a small company of an improved information system.

E. Big data is only applicable to large companies which have substantial funds to invest in information systems.

-

Question 66:

A manufacturing company has just developed a new product and must now determine the most appropriate pricing strategy for its initial launch.

The product will initially be unique because it will include highly desirable features that no competitive product offers. Its development has involved substantial expenditure and the company wishes to recover this as soon as possible.

The product's uniqueness is expected to last for only six months before a competitor launches a similar product. It is expected that the competitor will avoid any significant development costs by reverse engineering the company's own

product.

At that point, to remain competitive, the company must ensure that its selling price matches that of the competitor.

Which of the following pricing strategies would be most suitable for the initial launch of the company's product?

A. Market skimming

B. Penetration pricing

C. Dual pricing

D. Own label pricing

-

Question 67:

An airline company has operated passenger flights with low ticket prices to various airports from a busy airport for several years. It now faces increased competition on a number of its routes and has decided to use the balanced scorecard to

monitor its performance.

Which of the following statements are correct?

Select ALL that apply.

A. Customer satisfaction measures will not be needed because the company pursues a low price strategy for competitive advantage.

B. The proportion of seats that are occupied on flights could be a suitable measure for the internal business process perspective.

C. The number of new flights to different destinations could be a suitable measure for the learning and growth perspective.

D. The number of on time take-offs could be a suitable measure for the internal business process perspective.

E. Non-financial objectives will be met as a result of financial objectives being achieved.

F. A survey of passengers could be a suitable measure for the customer perspective.

-

Question 68:

Which TWO of the following statements are correct?

A. It is worthwhile for a company to sell further units when the marginal revenue is greater than the marginal cost.

B. Price is the only factor affecting the demand for products and services.

C. Premium pricing is possible when there is a measure of product or service differentiation.

D. Loss leadership pricing is appropriate for a new product which is not part of a range of products.

E. Demand functions can be predicted accurately and the relationship between price and quantity demanded is always constant.

-

Question 69:

Which of the following statements are correct with regard to responsibility centres? Select ALL that apply.

A. Revenue centre managers have a lower level of decision-making authority than profit centre managers.

B. Revenue centre managers and profit centre managers are accountable for controllable costs only.

C. Profit centre managers and investment centre managers are responsible for the majority of operating costs incurred.

D. Investment centre managers have a higher level of managerial authority than profit centre managers.

E. Managers of profit centres have authority over the level of investment in working capital but managers of cost centres do not.

-

Question 70:

A company is investing $150,000 in a project which will yield an annual cash inflow of $40,000 for eight years. The company's cost of capital is 10%. To the nearest $100, what is the project's equivalent annual net present value?

A. $11,900

B. $7,900

C. $63,400

D. $21,300

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRO19-P02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.