Exam Details

Exam Code

:CIMAPRO19-P02-1Exam Name

:P2 - Advanced Management AccountingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:202 Q&AsLast Updated

:Jun 29, 2025

CIMA CIMA Certifications CIMAPRO19-P02-1 Questions & Answers

-

Question 161:

Company TTM has the opportunity to invest $60,000 in a project. The project is anticipated to produce annual returns of $12,500 each year for 8 years. The cost of capital is 12%. What is the net present value of the project? Give your answer to the nearest whole number.

A. $2100

-

Question 162:

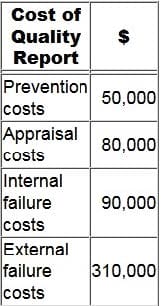

The following cost of quality report has been prepared for the latest period.

What is the difference between the cost of conformance and the cost of non-conformance?

A. $270000

-

Question 163:

Which of the following is the ideal basis to use for a transfer price when there is a perfect external market?

A. Actual variable cost

B. Market price

C. Standard variable cost

D. Full cost plus

-

Question 164:

Company D is about to launch an innovative and unique product which may face direct competition within three years. The company needs to achieve a rapid payback on all investments because it has limited access to external finance. Which is the most appropriate pricing strategy for company D's new product, and for what reason?

A. Market skimming because it exploits areas of the market which are sensitive to price.

B. Penetration pricing because it can be used to rapidly build sales volume in mature markets.

C. Market skimming because it enables high prices to be charged to buyers who want the product as soon as possible.

D. Penetration pricing because it can be used to rapidly build sales volume in high growth markets.

-

Question 165:

An organization is competing in the high technology market. It sets a high sales price for its products initially to target the early adopters, and then the price is gradually reduced. This pricing strategy is known as:

A. Market skimming

B. Penetration pricing

C. Premium pricing

D. Loss leader pricing

-

Question 166:

A company must decide today whether to proceed with a proposed project. If the project proceeds, the initial investment of $150,000 would be made in one year's time. The benefit of the project would be a perpetuity of $22,000 per year

commencing one year after the investment is made. The company's cost of capital is 14% per year.

To the nearest $100, what is the net present value of the project?

A. $6,300

B. $7,100

C. -$12,200

D. $25,600

-

Question 167:

An organization produces only two products. Each month it produces 1,000 units of product A and 10,000 units of product B.

Using traditional absorption costing the products have very similar unit costs. However when costs are calculated using activity-based costing (ABC), product A's unit cost is significantly higher than that of product B.

Which of the following factors has the potential to cause this difference? Select ALL that apply.

A. ABC cost calculations are not simply volume-related.

B. ABC costs are driven only by the volume of output.

C. ABC considers only marginal costs.

D. ABC uses multiple cost drivers to trace overhead costs to products.

E. ABC considers only direct costs.

-

Question 168:

To which technique for dealing with risk and uncertainty do ALL of the following statements apply?

It requires that only one factor is considered at a time.

It identifies areas which are crucial to a project, which can then be monitored if the project is chosen.

It does not provide an indication of the likelihood of any change in the factors.

Following the calculation, it requires the exercising of judgement to decide whether to accept or reject a project.

A. Sensitivity analysis

B. Probability analysis

C. Scenario analysis

D. Adjusting the discount rate to reflect risk.

-

Question 169:

A company is considering four mutually exclusive projects. There are three possible future demand conditions but the company has no idea of the probability of each of these demand conditions occurring. The forecast net present values (NPVs) of each of the four projects, under each of the three possible future demand conditions, are as follows.

Using the maximax criterion, which investment should be selected?

A. Investment A

B. Investment B

C. Investment C

D. Investment D

-

Question 170:

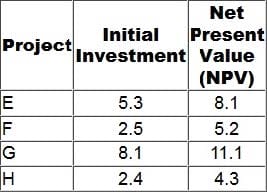

A company has a maximum of $2 million to invest and has identified four viable projects, E, F, G and H.

The initial investment for each of the projects is the maximum amount that can be invested in the project, but any amount up to the maximum can be invested. The projects are divisible.

The projects have been evaluated using net present value, as below. All figures are $ millions.

In which project should the company invest $2 million?

A. Project E

B. Project F

C. Project G

D. Project H

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRO19-P02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.