Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:Jun 04, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1781:

Roland Cad owns a portfolio of large capitalization stocks. He has a positive long term outlook for the stock market, but Carl is worried about the possible effects of recent changes in monetary policy. Carl would like to protect his portfolio from any sudden declines in the stock market, without selling his holdings. The most likely way for Carl to achieve his objective of limiting the downside risk of his portfolio is to:

A. sell put options on the SandP 500.

B. sell an SandP 500 futures contract.

C. buy an SandP 500 forward contract.

-

Question 1782:

Julia Chen, a portfolio manager for U.S.-based Dane Investments, has just established a short position in Swiss franc currency futures as part of a currency overlay strategy. The position consists of 100,000 contracts with an initial margin of $4,000, a maintenance margin of $2,500, and a contract price of 0.9120 USD/CHF. If the futures price on the subsequent two days is 0.9300, and 0.8928, respectively, what will be her margin account balance at the end of the second day?

A. $4,000

B. $6,200

C. $7,720

-

Question 1783:

Sue Wie, CFA, is the chief financial officer for Garth Company. The company will need to borrow S75 million in the near future to fund a plant expansion. Wie expects interest rates will rise and decides to hedge against this risk using a 3 * 6 LIBOR based forward rate agreement (FRA). The underlying rate for this FRA is:

A. 60-day LIBOR.

B. 90-day LIBOR.

C. 180-day LIBOR.

-

Question 1784:

Call options on the stock of Verdant, Inc., with a strike price of $45 are priced at $3.75. Put options with a strike price of $45 are priced at $3.00. Which of the following most accurately describes the potential payoffs for owners of these options (assuming no underlying positions in Verdant)?

A. The call writer has the maximum loss exposure.

B. The put buyer has the maximum loss exposure.

C. The put writer has the maximum potential gain.

-

Question 1785:

An analyst is considering buying a call option on ZXC stock, which is currently trading at $33.75 per share. Three month call options with a strike price of $30 are trading at a premium of $4.50. Identify which of the following statements is most likely true regarding the ZXC call options.

A. The ZXC call options are currently out of the money.

B. The breakeven underlying price for ZXC stock is $38.25 per share.

C. The potential upside of the ZXC call options is unlimited.

-

Question 1786:

IRK Investments is actively engaged in various risk management strategies involving swaps. The company currently has a position as the fixed rate payer in a quarterly fixed for equity swap with an interest rate of 6.8%, a tenor of five years and notional principal of $10 million. Payments on the swap are netted. The underlying equity return is based on the SandP 500 Index. IRK currently owes a payment of $400,000. Which of the following is most likely correct?

A. The underlying equity index experienced a loss greater than 1.7% over the quarter.

B. The underlying equity index experienced a loss less than 1.7% over the quarter.

C. The underlying equity index experienced a loss equal to 1.7% over the quarter.

-

Question 1787:

An analyst is interested in determining the value of a real estate investment and has estimated the following data for the property:

Net operating income $50,480 Cost of debt 8.2%

Depreciation $3,550 Cost of equity 12.5%

Interest expense $2,720 WACC 9.6%

Tax rate 35% Cap rate 11.0%

Which of the following is closest to the value of the property using the income approach?

A. $403,900

B. $458,900

C. $466,500.

-

Question 1788:

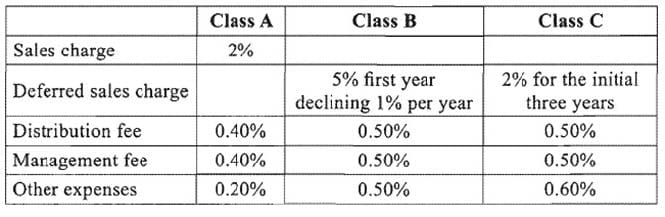

Bob Kramer, CFA, manages money for high net worth clients. Kramer creates an investment portfolio tailored to his clients' specific needs using mutual funds. Kramer is considering the following Emerging Market Fund and uses a live year time frame. Exhibit 1 details the Emerging Market Fund's fees and expenses. Exhibit 1 - Fees and expenses for Emerging Market Fund

Kramer expects the Emerging Market Fund to earn 12% per year.

Select the class of Emerging Market Fund shares that are most appropriate for Kramer's clients.

A. Class A

B. Class B

C. Class C

-

Question 1789:

Bond X is a nonmailable corporate bond maturing in ten years. Bond Y is also a corporate bond maturing in ten years, and Bond Y is callable at any time beginning three years from now. Both bonds carry a credit rating of AA. Based on this information, identify the most accurate statement:

A. Bond Y will have a higher nominal spread over a 10-year U.S. Treasury security than Bond X.

B. The option adjusted spread (OAS) of Bond Y will be greater than the nominal spread of Bond Y.

C. The nominal spread of Bond X will be greater than the option adjusted spread of Bond X.

-

Question 1790:

A Treasury bond dealer observes the following Treasury spot rates from the spot rate curve: 1-year 7.40%, 2-year 7.00%, and 3-year 6.3%. The bond dealer also observes that the market price of a 3-year 8% coupon, 100 par value bond is $103.95. Based on this information, the dealer should:

A. buy the 8% coupon bond in the open market, strip it, and sell the pieces.

B. sell the 8% coupon bond short, and buy the component cash flow strips with the proceeds.

C. do nothing since the 8% bond is selling for its arbitrage-free price.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.