Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:Jun 04, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1711:

Mary Hames has bought a long FRAwith a notional principal of $10 million. The agreement expires in 30 days, and is based on 90-day LIBOR. The FRA is based upon an initial rate of 4.75%. Assume that at expiration, 90-day LIBOR is 5.5%, and 60-day LIBOR is 5.25%. Calculate the payoff at expiration.

A. $12,338 paid to Hames.

B. $18,496 paid to Hames.

C. $19,008 paid to Hames.

-

Question 1712:

The Pairagain mutual fund has entered into an equity swap with SingleSol, LLC, with a notional principal of $50 million. Pairagain has agreed to pay the quarterly return on the NASDAQ 100 in exchange for a fixed rate of 7.0%. The initial price of the NASDAQ 100 was 1825, and the value at the end of the first quarter, 91 days later, was 1755. The swap uses a 365-day year convention. What is the net payment to be made at the end of the first quarter?

A. SingleSol pays $2,790,411.

B. SingleSol pays $1,917,808.

C. SingleSol pays $872,603.

-

Question 1713:

The value of an existing single-family home used for residential purposes will most likely be calculated using the:

A. cost approach.

B. income approach

C. sales comparison approach

-

Question 1714:

Sharon Foster owns a portfolio of two bonds. The first bond is a mortgage backed security (MBS) with a coupon rate well above current market rates for securities with similar characteristics. Foster also owns a callable corporate bond with five years to maturity and a coupon rate of 9%. The bond is nonrefundable. Comparable corporate issues brought to market recently were priced to yield 6.5%. The risks that Sharon faces by holding each of these securities could best be described as:

A. interest rate risk for the MBS, and call risk for the corporate bond

B. price compression for the MBS, and reinvestment risk for the corporate bond

C. prepayment risk for the MBS, and call risk for the corporate bond

-

Question 1715:

Michelle Garcia, CFA, is analyzing two newly issued corporate debt securities for possible purchase by a client. Bond X is a noncallable 10-year coupon bond currently trading at 102.50. Bond Y is a noncallable 10-year coupon bond currently trading at 98.25. Garcia wants to ensure that her client is fully aware of any probable changes in the bonds' values as they approach maturity. Holding interest rates constant, which of the following best describes how each bond's price will change as it approaches maturity?

A. The price of both bonds will decrease.

B. The price of Bond X will decrease, and the price of Bond Y will increase.

C. The price of Bond X will increase, and the price of Bond Y will decrease.

-

Question 1716:

The bonds of Grinder Corp. trade at a nominal spread of 150 basis points (bp) above comparable maturity

U.S.

Treasury securities. The option adjusted spread (OAS) on the Grinder Corp. bonds is 75 bp. Using this information, and assuming that the Treasury yield curve is flat, which of the following statements is most likely to be true?

A.

The zero-volatility spread should be 75 bp.

B.

The zero-volatility spread for these bonds is 225 bp.

C.

The option cost component of these bonds should be 75 bp.

-

Question 1717:

Tony Horn, CFA, is evaluating two bonds. The first bond, issued by Kanon Corp., pays a 7.5% annual coupon and is priced to yield 7.0%. The second bond, issued by Samuel Corp., pays a 7.0% annual coupon and is priced to yield 8.0%. Both bonds mature in ten years. If Horn can reinvest the annual coupon payments from either bond at 7.5%, what would his return be on each bond, assuming the bond was held to maturity?

A. Greater than 7.0% on the Kanon bonds and less than 8.0% on the Samuel bonds.

B. Less than 7.0% on the Kanon bonds and less than 8.0% on the Samuel bonds.

C. Greater than 7.0% on the Kanon bonds and greater than 8.0% on the Samuel bonds.

-

Question 1718:

Maria Reyes, CFA, recently purchased a 10 year floating rate bond which is reset semiannually. The bond's coupon is based on the six-month Treasury rate plus 200 basis points with a cap of 8.50%. Identify the TRUE statement regarding these floating rate bonds.

A. The maximum coupon rate on these bonds would occur when the six-month Treasury bill was at 8.50% .

B. These floating rate bonds have more interest rate risk than comparable floating rate bonds that reset annually.

C. If the six-month Treasury rate has been greater than 7.00% for the past 12 months, these bonds will be priced similar to comparable fixed rate securities.

-

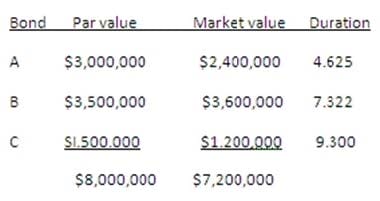

Question 1719:

Chris Renburg owns the following portfolio of option-free bonds: Calculate the duration of Renburg's bond portfolio.

A. 6.682

B. 6.753

C. 7.082

-

Question 1720:

A large silver mining corporation in Australia is expecting to have three large inflows of raw silver resulting from a discovery of three silver seams that were previously undetectable. The firm expects the first silver inflow to be ready for sale in nine months, followed by the second inflow three months later and the final inflow six months later. The mining company is expecting the price of silver to begin a downward trend for the next 18 months and wants to hedge the expected inflows without exposing themselves to credit risks. The most appropriate instrument the company should use is a:

A. series of futures contracts expiring in 9, 12, and 15 months.

B. series of forward contracts expiring in 9, 12, and 15 months

C. swap contract with payments in 9, 12, and 15 months

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.