Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:Jun 04, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1631:

Brad Rich uses an investment strategy that assumes stock prices will not reflect quarterly earnings surprises as quickly as suggested by the efficient market hypothesis. Rich believes stocks will earn positive abnormal rates of return over the six months following an earnings surprise. Which form of the efficient market hypothesis would this violate?

A. None.

B. Weak form only.

C. Semistrong and weak forms only.

-

Question 1632:

One year ago, Yong Kim bought a preferred stock that had a 6% dividend yield. Now, one year later, Kim sells the stock which is how selling at a 5% dividend yield. The preferred stock pays a fixed annual dividend, which Kim received right before selling. What rate of return did Kim realize on his investment?

A. 14%.

B. 20%.

C. 26%.

-

Question 1633:

Roger Templeton, an analyst for Bridgetown Capital Management, is studying past market data to identify risk factors that produce anomalous returns. He tests monthly data on each of 60 financial and economic variables over a 15-year period to find which ones are related to stock index returns. Based on this research, Templeton identifies three variables that show statistically significant relationships with equity returns. He presents his results to Bridgetown's managers and recommends implementing a trading program based on changes in these three variables. What is the most likely reason why Bridgetown's management should be skeptical of the anomalies Templeton has identified? The results suffer from:

A. data mining bias

B. survivorship bias

C. small sample bias

-

Question 1634:

Horace Lance, CFA, states that the efficient market hypothesis and its rigorous testing have yielded many

benefits to investors. Lance makes the following statements concerning an efficient market.

Statement I:The Efficient Market Hypothesis (EMH) assumes that changes in security prices occur in a

random fashion.

Statement 2:Portfolio managers should reduce trading turnover of client accounts.

Statement 3:The EMH establishes that the expected rate of return is the risk-free rate plus a risk premium

that is the security beta times the market price of risk.

Which of Lance's statements is least likely to be correct?

A. Statement 1

B. Statement 2

C. Statement 3

-

Question 1635:

A call option on Hartco stock with an exercise price of S50 and an expiration date one year from now is worth $4.00 today. A put option on Hartco stock with an exercise price of $50 and an expiration date one year from now is worth $2.25 today. U.S. Treasury notes maturing in one year are yielding 2.0%. Hartco does not pay a dividend. The value of Hartco*s stock is closest to:

A. $43 per share

B. $47 per share

C. $51 per share.

-

Question 1636:

Pamela Burke is a cotton farmer in Texas. Her crop will be ready for harvest in three months, but Burke does not believe prices will remain at their current level. Burke contacts Brooke Anderson, a derivatives dealer, to negotiate a forward contract. Anderson agrees to be the counter party to a forward contract that will eliminate Burke's exposure to the price of cotton. The contract is structured as a nondeliverable forward with a contract price of S47. If the price of cotton is $49 in three months, which counter party will be exposed to the greater amount of credit risk and which counter party will make a payment?

A. Burke will be exposed to greater credit risk, and Anderson will make a payment.

B. Anderson will be exposed to greater credit risk, and Burke will make a payment.

C. Burke will be exposed to greater credit risk, and Burke will make a payment.

-

Question 1637:

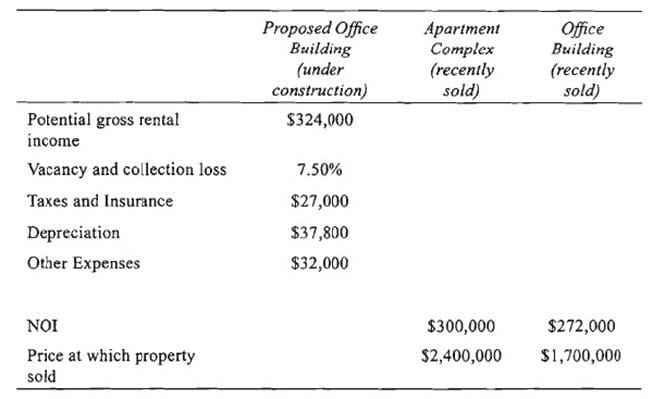

The annual income and expense figures for a proposed property under consideration for purchase, along with some recent sales data, are given below.

The appraised value for the proposed property using the income approach is closest to:

A. $1,268,125

B. $1,504,375

C. $1,623,200

-

Question 1638:

Jerry Paris, CFA, manages a high yield bond fund. 20% of Paris' portfolio is invested in distressed securities. A colleague commented that investing in distressed securities is analogous to venture capital investing. Which of the following statements concerning distressed securities and venture capital is least likely to be true? An investment in distressed securities is similar to an investment in venture capital because both:

A. are illiquid,

B. are normally priced efficiently.

C. require a long time horizon.

-

Question 1639:

Ken Willis is the portfolio manager of an aggressive growth fund. Ken is concerned about the future performance of his high-beta portfolio in light of his belief that the stock market is currently overvalued. Willis' firm requires that he maintain at least 80% of the portfolio's value in equities at all times. Willis decided his best course of action is to buy put options to protect the portfolio from the potential loss resulting from a market decline. The profits and losses from an equity portfolio combined with long puts would have risk characteristics similar to a:

A. long call option.

B. short put and long call position.

C. None

-

Question 1640:

Bill Turner, CFA, is short a futures contract on wheat. Turner entered into the futures position three months ago at a contract price of $50. The contract expiration is tomorrow. The settlement prices for the past four days (from oldest to most recent) were $56, $53, $49, and $52. If the settlement price on the expiration day is $57, which of the following best describes a method Turner is most likely to use to terminate his futures contract?

A. Sell a futures contract for $57 and receive a mark-to-market profit of $5.

B. Buy a futures contract for $57 and incur a mark-to-market loss of $5.

C. Leave the contract open, deliver the wheat to the long, and receive a price of $57.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.