Exam Details

Exam Code

:CCRAExam Name

:Certified Credit Research AnalystCertification

:AIWMI CertificationsVendor

:AIWMITotal Questions

:84 Q&AsLast Updated

:Jul 04, 2025

AIWMI AIWMI Certifications CCRA Questions & Answers

-

Question 11:

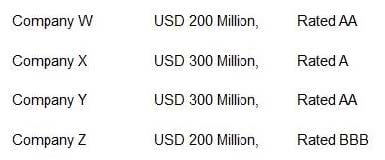

Bank A has an imaginary portfolio of USD 1000 Million distributed towards following four entities:

Bank A is stipulated to maintain a capital adequacy ratio of 11% on its risk weighted assets. It is being stipulated that the ratings for all the four entities is expected to be downgraded by 1 notch each. Estimate the amount of new capital required for Bank A?

A. USD 93.5 Million

B. USD 38.5 Million

C. USD 55 Million

D. USD 850 Million

-

Question 12:

Which of the following is not an importance of the sovereign rating?

A: To arrive at cost of lending to a country

B: To set lower floor for the rating of the corporate and banks of the countries on international scale.

C:

For determining the risk levels for international investment portfolios

A.

Only A and C

B.

Only B

C.

Only A and B

D.

None of the three

-

Question 13:

In a weakening economy, which of the following is least accurate?

A. Interest costs go up and create refunding risk for those who have bonds maturing which need to be rolled over.

B. Interest costs go up and create rate risk for have bonds maturing which need to be rolled over.

C. None of the other options.

D. Interest costs go up and create funding risk for those who have borowing plans lined up.

-

Question 14:

Awesome Mobile Ltd is a leading mobile seller who manufactures mobile phone under own brand Awesome. Which of the following is the biggest business risk for Awesome?

A. Technology Risk

B. Branding risk

C. Raw material price risk

D. Competition

-

Question 15:

Based on the Moody's KMV model which of the following is not correct?

A: Growth variables are important for default analysis. rapid growth will lead to lower probability of default and rapid decline will lead to higher probability of default.

B:

Activity ratios are relevant for default analysis. A large stock of inventories relative to sales will lead to a higher probability of default.

A.

Only Statement A is correct

B.

Both the statements are correct

C.

None of the statements is correct

D.

Only Statement B is correct

-

Question 16:

Butterfly strategy is a combination of

A. Ladder and Barbell on the same market sides

B. Barbell and Bullet on the opposite market sides

C. Barbell and Bullet on the same market sides

D. Ladder and barbell on the opposite market sides

-

Question 17:

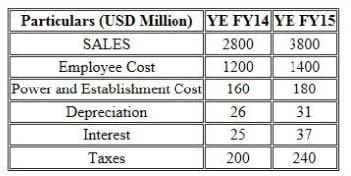

Based on the common size statement analysis which of the following statement regarding employee cost is correct?

A. The employee cost is expected to contribute 8% to decrease in PAT in FY15

B. The employee cost is expected to contribute 7% to decrease in PAT in FY15

C. The employee cost is expected to contribute 6% to decrease in PAT in FY15

D. The employee cost is expected to contribute 5% to decrease in PAT in FY15

-

Question 18:

The most important metric for a bank is the Net Interest Income (NII) which is the difference between____income and____expense.

A. Interest; Total

B. Interest; Fee

C. Interest; Interest

D. Total; Total

-

Question 19:

A holder of which of the following types of bonds is least likely to suffer from rising interest rates?

A. Floating rate bonds

B. Fixed rate bond

C. Zero-coupon bonds

-

Question 20:

Which of the following statements concerning having a CEO serve as chairman of the board is most accurate? Having a CEO also serve as chairman is considered:

A. poor corporate governance practice as having the CEO server as chairman is an inherent conflict when determining management compensation.

B. good corporate governance practice as the CEO is the best person to provide the board with information about the company's strategy and operations.

C. cannot be determined

D. poor corporate governance practice as having the CEO and chairman serve as separate positions ensures a properly-functioning board.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AIWMI exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CCRA exam preparations and AIWMI certification application, do not hesitate to visit our Vcedump.com to find your solutions here.