Exam Details

Exam Code

:CVAExam Name

:Certified Valuation Analyst (CVA)Certification

:NACVA CertificationsVendor

:NACVATotal Questions

:251 Q&AsLast Updated

:Jul 02, 2025

NACVA NACVA Certifications CVA Questions & Answers

-

Question 211:

A unique feature of Merger stat/Shannon Pratt's control premium study is a transaction code by type of transaction. i.e.:

A. F- Financial H-Horizontal integration V-Vertical integration C-Conglomerate

B. F- Financial H-Hedged Value V- Vertical integration C- Corporations

C. F- Funds H- Horizontal value V- Vertical value C- Control value

D. C- Control and control risk H- Hedging F- Financial V-Vulnerability

-

Question 212:

_________ is the value to some particular owner or potential owner, is found often in the context of mergers and acquisitions and in family law disputes.

A. Marketable value

B. Control Value

C. Investment value

D. Strategic Control value

-

Question 213:

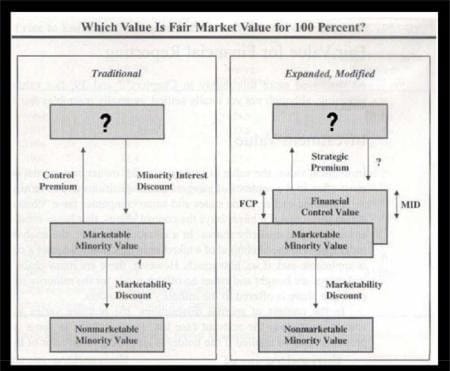

Which of the following best suits in replacement to question marks from left to right respectively?

A. Control value, strategic control value

B. Enterprise value, control value

C. Strategic value, Enterprise value

D. Tangible value, Intangible value

-

Question 214:

Below is a partial listing of possible scenarios in_________________.

-100 % control

-More than a majority or supermajority, but less than 100%

-More than 50% but less than a supermajority, where state statutes or articles of incorporation require a

supermajority

-50 %

-Less than 50 % but "effective control"

-Minority shares that control by voting block

A. Control spectrum

B. Control or lack of control spectrum

C. Discount for lack of control or minority discounts

D. B and C both are the same

-

Question 215:

Control shares are normally more valuable than minority shares because they contain a bundle of rights that minority shares do not enjoy. Below is a list of some of the rights. Which of the following is NOT out of such rights?

A. Appoint or change operational management

B. Determine management compensation and prerequisites

C. Set operational and strategic policy and change the course of business

D. Negotiate and consummate goodwill

-

Question 216:

The same general processes and decision criteria apply to both (1) deciding on whether or not to rely on any particular valuation multiple at all and (2) deciding on the relative weight to be accorded each valuation multiple ultimately used in reaching the opinion of value. A study of the transactional data may lead to greater of lesser reliance on certain valuation multiples than one might have expected prior to compiling the data a. All of the following are considered in impact of guideline transactional data evaluation EXCEPT:

A. Number of data points available

B. Comparability of data measurement

C. Comparability of data patterns

D. Apparent business reliance

-

Question 217:

Documentable, arm's-length, bona fide offers to buy or sell may also be useful evidence of value. Funded bona fide offers (i.e. offers for which the financing for the offer is already in place) should be gives more weight and more consideration than:

A. Past subject company changes

B. Merger and acquisition offers

C. Unfunded bone fide offers

D. Past acquisition documents by the subject company

-

Question 218:

1.

Pratt's stats

2.

Done deal

3.

Bizcomps

4.

IBA market database

These are the four databases devoted to:

A. Middle-market

B. Small company controlling ownership

C. Middle market and small company controlling ownership interest transactions

D. Shareholders' equity

-

Question 219:

As with any secondary sources, errors and inconsistencies occur, so the original source documents are the only guarantees of absolute accuracy as a source of merger and acquisition data. Which one of the following is NOT out of those original source documents?

A. Mergerstat Review

B. The merger yearbook

C. Buyouts, published every other week by securities data publishing

D. Financial reports

-

Question 220:

In merger market valuation models:

A. We compare prices among similar companies, much like comparison shopping for a consumer item among similar retail stores

B. Corporations are not yellow pencils, quickly stacked and easily matched

C. Every MandA sale cannot be considered special or extraordinary

D. M and A market mostly evinces aberrations

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only NACVA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CVA exam preparations and NACVA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.