Exam Details

Exam Code

:3I0-012Exam Name

:ACI Dealing CertificateCertification

:ACI CertificationsVendor

:ACITotal Questions

:740 Q&AsLast Updated

:Aug 22, 2025

ACI ACI Certifications 3I0-012 Questions & Answers

-

Question 501:

What happens when the issuer of a bond being used as collateral in a classic repo fails to pay a coupon on the bond during the term of the repo?

A. The transaction is terminated and the collateral is returned to the seller

B. The transaction is rolled over until the coupon is paid or the issuer becomes insolvent, at which point the seller becomes an unsecured creditor of the issuer

C. The buyer is obliged to make a manufactured payment to the seller and becomes an unsecured creditor of the issuer

D. The buyer is not obliged to make a manufactured payment to the seller but the buyer is likely to ask for margin

-

Question 502:

Which of the following is not transferable?

A. Euro certificate of deposit

B. US Treasury bill

C. CP

D. Call deposit

-

Question 503:

Which of the following may pay a return as a mix of income and capital/gain loss?

A. CD

B. Interbank deposit

C. Classic repo

D. Treasury bill

-

Question 504:

You have quoted your customer the following CAD deposit rates:

1M 1.00-05% 2M 1.06-11% 3M 1.13-18%

The customer says, "I give you CAD 20,000,000.00 in the two's". What have you done?

A. Borrowed CAD 20,000,000.00 at 1.06%

B. Lent CAD 20,000,000.00 at 1.11%

C. Borrowed CAD 20,000,000.00 at 1.11%

D. Lent CAD 20,000,000.00 at 1.06%

-

Question 505:

You borrow GBP 2,500,000.00 at 0.625% for 165 days. How much do you repay including interest?

A. GBP 2,507,161.46

B. GBP 2,507,063.36

C. GBP 2,507,006.85

D. GBP 2,507,106.16

-

Question 506:

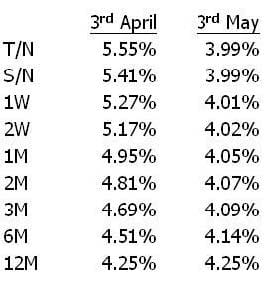

The columns below list short-term cash rates on 3rd April and 3rd F1ay 3rd April 3rd May

Describe the shape of the short-term segment of the yield curve on 3' April using market terminology. In addition, describe the change in the shape of the curve between 3rd April and 3rd May.

A. Positive, steepening

B. Positive, flattening

C. Inverted, steepening

D. Inverted, flattening

-

Question 507:

7-day USCP is quoted at a rate of discount of 1.75%. What is its true yield?

A. 1.73%

B. 1.75%

C. 1.77%

D. 1.80%

-

Question 508:

What is the name of the reference against which most USD and JPY deposits and loans are fixed in London?

A. EURIBOR

B. EONIA

C. LIBOR

D. SONIA

-

Question 509:

Which of the following dealing strategies involves the placing of orders with very short quote lives into a market?

A. frequency trading

B. high-incidence trading

C. flash trading

D. liquidity aggregators

-

Question 510:

A 3-month (90-day) NZD deposit is 2.75% and 6-month (180-day) NZD deposit is 3.00%. What is the 3x6 NZD deposit rate?

A. 3.2281%

B. 3.2278%

C. 3.00%

D. 2.875%

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only ACI exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your 3I0-012 exam preparations and ACI certification application, do not hesitate to visit our Vcedump.com to find your solutions here.