1Z0-1060-22 Exam Details

-

Exam Code

:1Z0-1060-22 -

Exam Name

:Oracle Accounting Hub Cloud 2022 Implementation Professional -

Certification

:Oracle Certifications -

Vendor

:Oracle -

Total Questions

:60 Q&As -

Last Updated

:Jan 14, 2026

Oracle 1Z0-1060-22 Online Questions & Answers

-

Question 1:

Given the business use case:

'New Trucks' runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, In some cases, 'New Truck' may procure other trucks by renting them from third parties to their customers. When trucks are leased, the Internal source code is 'L'. When trucks are owned, the internal source code is 'O'. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the "New Trucks* company has a subsidiary company 'Fix Trucks' that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, 'New Trucks' needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income. 'New Trucks' and' Fix Trucks' are located in the same country and share chart-of accounts and accounting conventions.

How many ledgers are required to be set up?

A. Two primary ledgers

B. One primary ledger

C. One primary, one secondary ledger

D. One primary, one repotting currency ledger -

Question 2:

What is NOT included in the minimum required accounting attribute assignments?

A. Second Distribution Identifier

B. First Distribution Identifier

C. Distribution Type

D. Accounting Date -

Question 3:

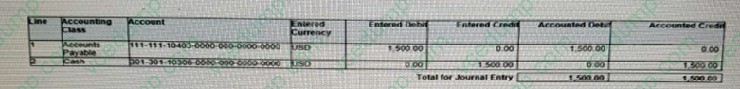

Given the subledger journal entry:

Note that the first segment is the primary balancing segment. Which statement is True regarding this subledger journal entry?

A. It is not balanced by balancing segment.

B. It is not balanced by entered currency.

C. It is not balanced by entered amounts.

D. It appears correct. -

Question 4:

Given the business use case:

'New Trucks' runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, 'New Truck' may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is 'L'. When trucks are owned, the internal source code is 'O'. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the "New Trucks* company has a subsidiary company 'Fix Trucks' that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, 'New Trucks' needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

How can the automatic recognition of insurance income be implemented in Accounting Hub Cloud?

A. Set up multiperiod accounting journal lines.

B. Set up a transaction line reversal.

C. Create an adjustment journal entry.

D. Set up automatic Journal line reversal. -

Question 5:

Given the business use case:

'New Trucks' runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, 'New Truck' may procure other trucks by renting them from third parties to their customers. When trucks are

leased, the internal source code is 'L'. When trucks are owned, the internal source code is 'O'. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The

insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the "New Trucks* company has a subsidiary company 'Fix Trucks' that maintains its own profit and loss entity. To track all revenue,

discounts, and maintenance expenses, 'New Trucks' needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

What do you do to enable costs flow from 'New Truck' to 'Fix Truck'?

A. Enable intercompany balancing option

B. Enable balancing rules

C. Enable legal entity rule

D. Enable chart of accounts rule -

Question 6:

Given the business use case:

'New Trucks' runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, 'New Truck' may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is 'L'. When trucks are owned, the internal source code is 'O'. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the "New Trucks* company has a subsidiary company 'Fix Trucks' that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, 'New Trucks' needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

How do you set up an account rule that is based on leased and owned trucks?

A. Set up a mapping set rule.

B. Set up a lookup value.

C. Set up a value set rule.

D. Set up an account source in the source system file and derive the value. -

Question 7:

Which transaction source is used to link transaction header and line information?

A. Transaction Key

B. Transaction Type

C. Transaction Date

D. Transaction Number -

Question 8:

You are explaining to an accountant that account override is an adjustment feature of Subledger Accounting.

Which two traits can help you explain this feature?

A. The account override feature provides an audit trail by preserving the original subledger journal entry.

B. The account override feature adjusts the original source transaction.

C. The account override feature is only intended to correct subledger journals that have been posted.

D. The account override feature allows users to record a reason for the adjustment. -

Question 9:

Most of the accounting entries for transaction from the source system use TRANSACTION_AMOUNT as a source of the entered amount accounting attribute. For some events, you need to use the TAX_AMOUNT source.

At what level can you override the default accounting attribute assignment?

A. Journal Entry

B. Journal Entry Rule Set

C. Event Class

D. Journal Line Rule

E. Event Type -

Question 10:

To support foreign currency transaction in Accounting Hub, which accounting attributes must be assigned a source?

A. Conversion type and conversion date

B. Conversion type, conversion date and conversion rate

C. Conversion date and conversion rate

D. Conversion type

Related Exams:

-

1Z0-020

Oracle8i: New Features for Administrators -

1Z0-023

Architecture and Administration -

1Z0-024

Performance Tuning -

1Z0-025

Backup and Recovery -

1Z0-026

Network Administration -

1Z0-034

Upgrade Oracle9i/10g OCA to Oracle Database OCP -

1Z0-036

Managing Oracle9i on Linux -

1Z0-041

Oracle Database 10g: DBA Assessment -

1Z0-052

Oracle Database 11g: Administration Workshop I -

1Z0-053

Oracle Database 11g: Administration II

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Oracle exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your 1Z0-1060-22 exam preparations and Oracle certification application, do not hesitate to visit our Vcedump.com to find your solutions here.